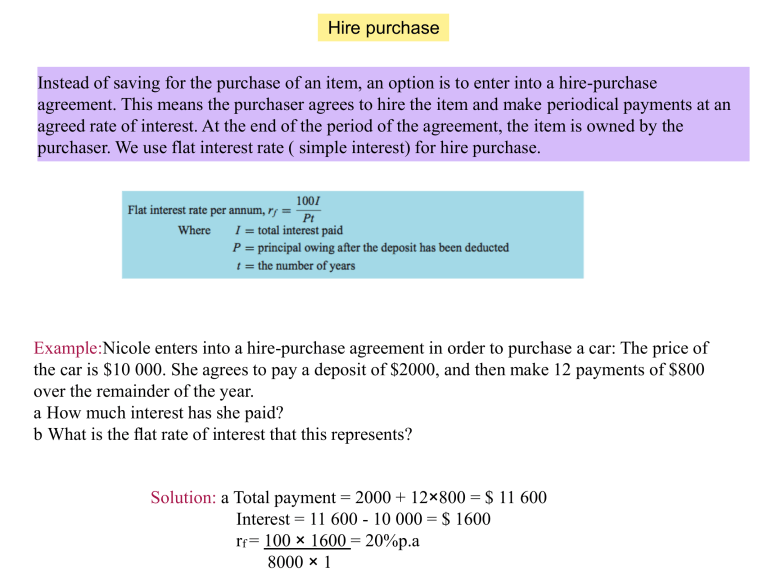

The instalments include both repayment of the debt and the interest being charged by the vendor. The car costs 10000 and it requires to pay 30 initial payment and the remaining balance will be paid monthly with interest expense.

Hire Purchase Meaning Agreement Calculation What Is It

A low interest rate means more affordable.

. Initial payment 10000 30 3000. He or she then makes regular repayments instalments. HIRE PURCHASE Under a HIRE PURCHASE contract a purchaser pays an initial deposit and takes the item away.

If you do not know your interest rate enter your monthly payment and we. We will calculate your payments total costs total interest charged and provide a schedule of payments detailing each month of the contract to show you the remaining balance at each payment. Find out the cash value.

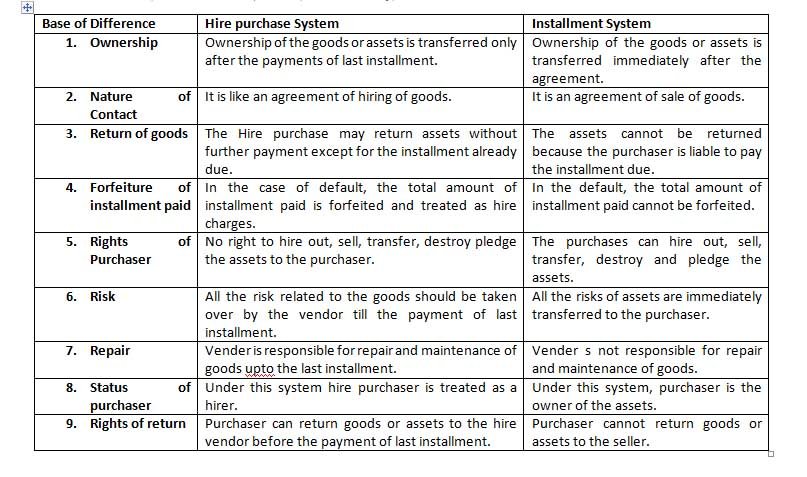

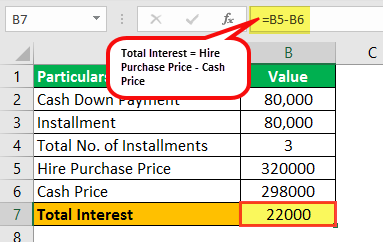

The entire amount goes to reduce the cash price. This is the third problem of Hire Purchase which is based on the third scenario when Rate of Interest is NOT givenHere I have shown how to calculate the rat. Ownership of the goods is transferred when the last instalment is paid.

Find out the cash value. This hire purchase calculator will show the principal and interest costs per month to show the level of extra payments on top of the items price that you will be paying as well as the size of the monthly principal payments. Most Hire Purchase car finance interest rates range from 4 to 9 and these figures are manageable for most people looking to finance a car.

How is hire purchase interest calculated. 55840 Down payment Rs. Question 4 The purchase price of a car is 15 000.

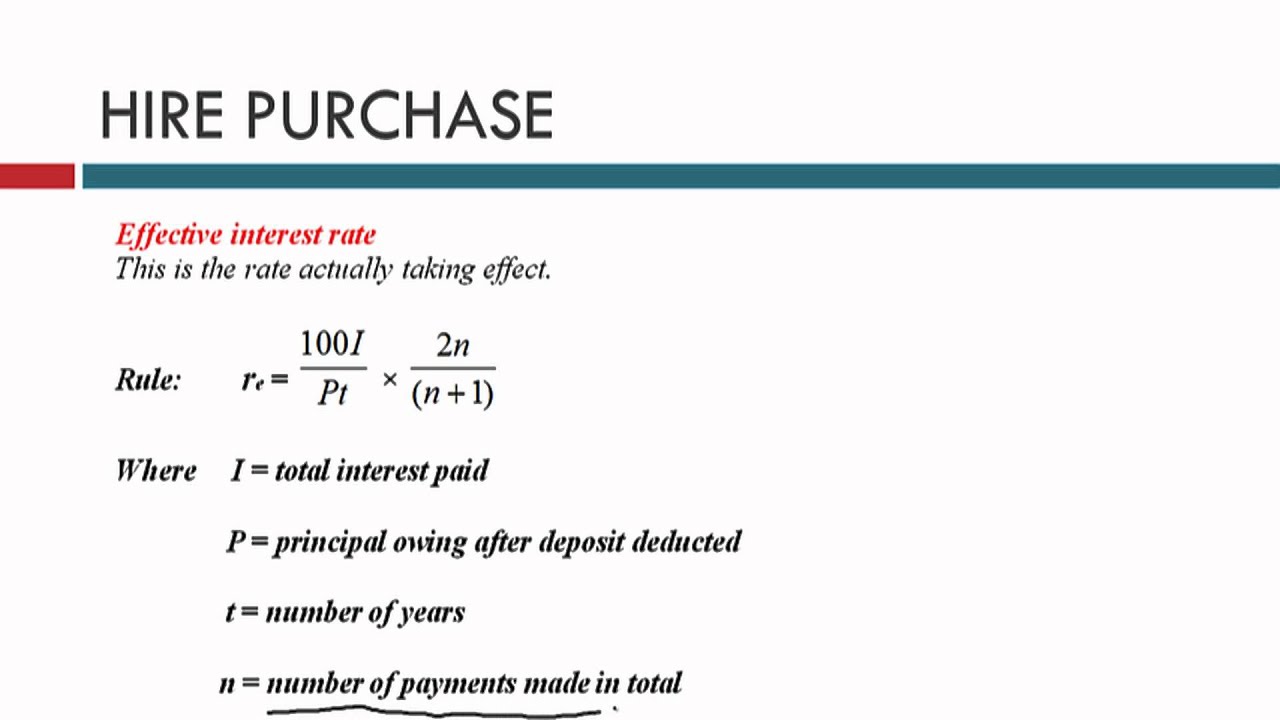

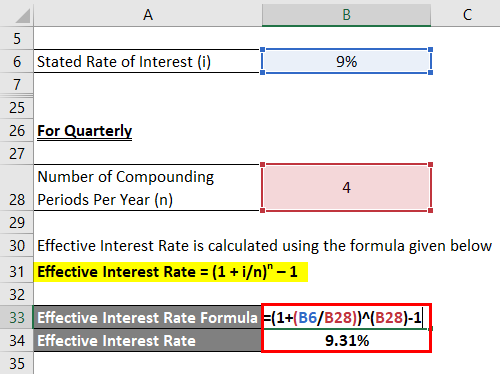

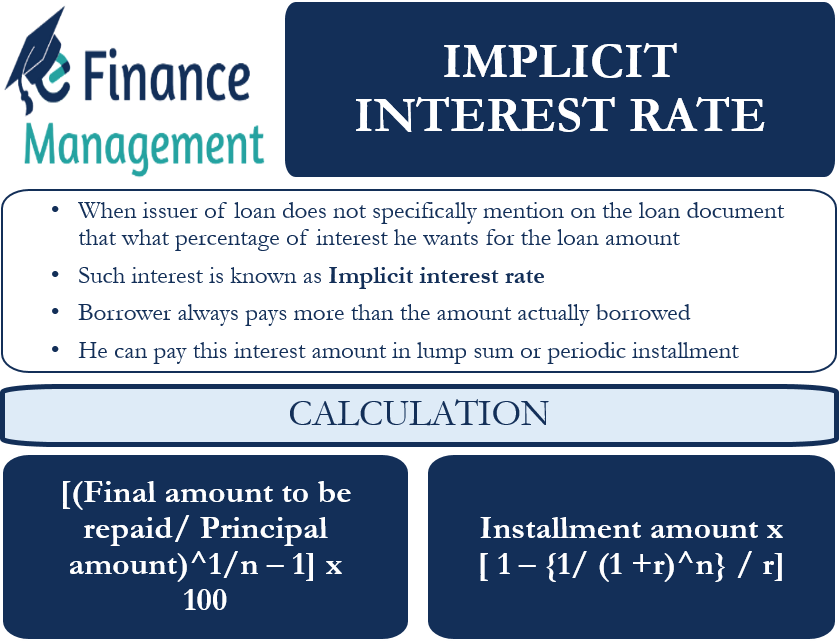

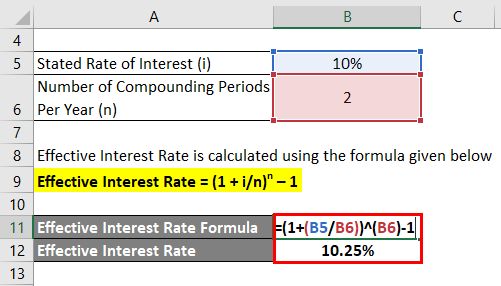

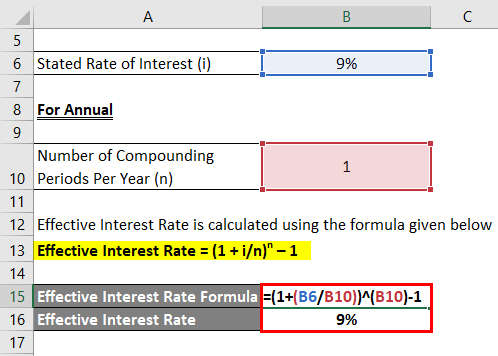

There is no time gap between the signing of the agreement and the cash down payment of Rs 3000 112003. 000 Total Payment RM. The effective rate of interest in a hire purchase agreement is the interest rate that would be charged in an equivalent reducing balance loan.

The monthly payment over 3 years is equal to 200. At the end of the period of the agreement the purchaser owns the item. Most hire purchase deals are done over 36-60 month periods because this is how the lender achieves the highest interest.

Hence no interest is calculated. MoneyWorks accounting software When purchasing office equipment or machinery business owner frequently use Hire Purchase to finance their purchases. The interest charged 5 pa.

If the hire purchaser becomes defaulter the hire vendor has the right to take away the goods and forfeit the instalments received as hire charges for the use of goods. A and company ABC have made the hire purchase agreement of the car. Hire Purchase System - Features Under the hire purchase system goods are sold on instalment basis.

How to use Hire Purchase Car Loan Calculator Malaysia. Interest Rate pa. There are multiple accounts involved in hire purchase transactions.

000 Monthly Repayment RM. Assuming you purchase a. Learn More 3 types of Car Insurance in Malaysia find out How Much You Can Loan From Bank.

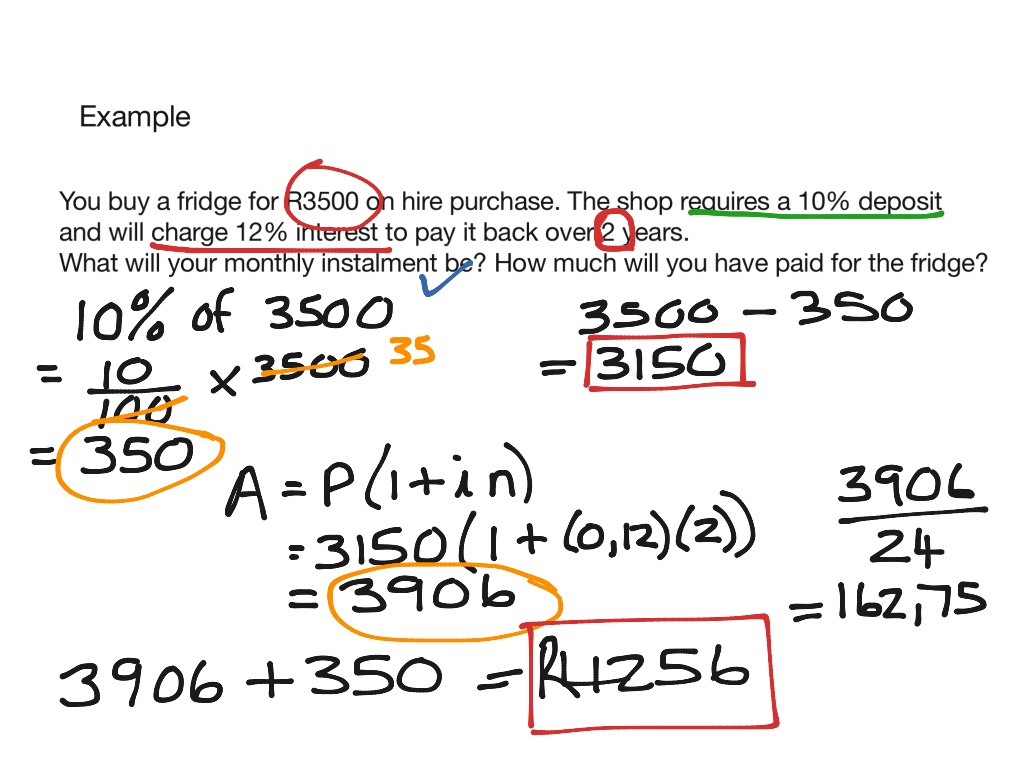

The interest charged 5 pa. The monthly instalment is calculated as follows. Get estimate from our hire purchase calculator to help you to calculate possible monthly repayments.

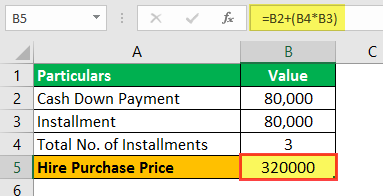

Thats a whopping difference of RM24808 compared to the Flat Interest Rate option. The interest in the last installment is taken at the differential figure of Rs 28550 3000 271450. Company purchase the furniture on hire purchase and the instalment for 3 years is Rs.

Key in Car price Downpayment Loan No. Hiring Period in Years Calculate. Interest amount per instalment Interest rate per instalment x Outstanding loan amount.

Use our HP Hire Purchase calculator to get a full breakdown of your HP deal. 3 000 2 000 and 1 000. Of Years and Car Loan Interest Rate The calculator will automatically calculates the Loan Amount Total interest charges and Monthly payment for you.

Calculate the effective rate of interest under the terms of this agreement. Interest rates are calculated as a percentage of the loans value so if you can find lenders offering lower interest rates the better it would be for you. HPP 15000 15000 3 60000 Total Interest HPP Cash Price 60000 55840 4160 This interest shall be distributed among three years in the ratio of outstanding instalments or Outstanding HPP.

Monthly Instalment Amount financed Total interest on amount financed Repayment period months RM50000 RM25000 60 RM75000 60 RM1250 Since term charges are calculated on the initial amount financed you will get a rebate on the term charges if you repay in full the balance due under the hire purchase HP. While the Reducing Balance Rate seems a lot more appealing than Flat Interest. 15000 Annual Instalments 3 of Rs.

Although more calculations are input for this type of interest the formula is fairly simple. Calculated Interest Charges RM. There are fixed asset Hire Purchase Creditor Interest in Suspense and HP Interest expense accounts.

How To Calculate Flat Rate Interest And Reducing Balance Rate

Hire Purchase System Part I Wikieducator

Realtimme Cloud Solutions Helpfile

Hire Purchase Meaning Agreement Calculation What Is It

Hire Purchase And Installment Purchase Indiafreenotes

Effective Interest Rate Formula Calculator With Excel Template

2 Hire Purchase Accounting Calculation Of Interest When Rate Of Interest Is Not Given Kauserwise Youtube

Hire Purchase Meaning Agreement Calculation What Is It

Hire Purchase System Part I Wikieducator

Implicit Interest Rate Meaning Calculation And Use Examples

Effective Interest Rate Formula Calculator With Excel Template

1 Hire Purchase System Calculation Of Interest Introduction With Solved Problem Kauserwise Youtube

Accounting For Hire Purchase Accounting Education

Rate Simple Interest For Hire Purchase

Finance Hire Purchase Math Showme

Effective Interest Rate Formula Calculator With Excel Template

Effective Interest Rate Formula Calculator With Excel Template

How Is The Price Of A Hire Purchase Calculated Osv